What Is UPI And How Does PhonePe Use It

Unified Payments Interface (UPI) is a high-tech online payment system introduced by National Payments Corporation of India (NPCI) with the vision to enable instant and easy transfer of funds from one bank account to another through a mobile-based system. UPI is a new-generation payment system that was launched with the vision to make banking fast, secure, and convenient. UPI changed the platform of online transactions in India. Unlike the traditional banking process of typing long account numbers, IFSC codes, or complex details, UPI makes things easier by allowing users to send money using a virtual payment address (VPA) that is easy to remember and use. A VPA is a unique identification that resembles an email address and is directly linked to the user’s bank account. For example, YourName@BankName can be a VPA, and that address can be used to receive money or make payments without exposing sensitive banking information.

UPI is 24×7, even on weekends and bank holidays. It supports instant payments – the instant a payment is initiated, the amount of money is automatically deducted from the paying party’s account and automatically credited to the receiver’s account. The reason for such a real-time configuration is that UPI is designed to be so easy and quick to use by anyone and everyone—consumers and business persons alike. UPI is simply a mobile phone platform that integrates many of the capabilities of banks such as bills, balances, and transferring accounts into a single software. UPI is particularly secure and reliable in that every transaction must be verified by the user via a secure UPI PIN, which is a 4- or 6-digit user-private code.

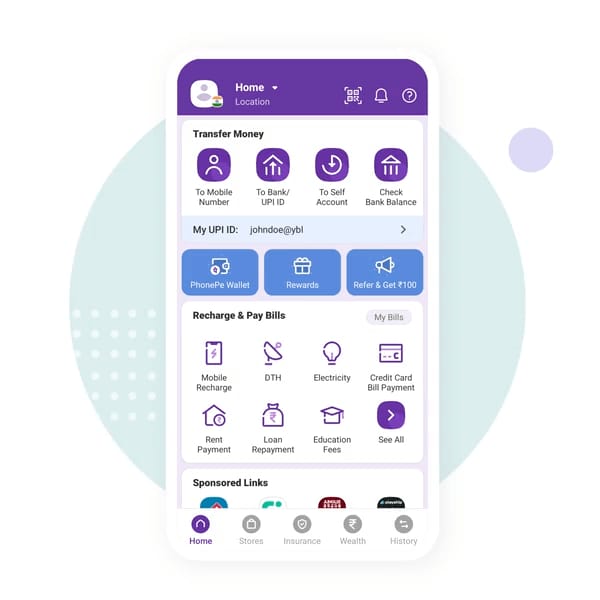

PhonePe, the most popular digital payment app used in India, relies on the UPI system as its backend technology. When a user downloads and signs up for the PhonePe mobile app, the application itself identifies the user’s mobile number and links it with his bank account using the UPI platform. Once the user’s bank account is linked, the user can select a personal UPI PIN to validate all subsequent transactions. Thanks to this arrangement, the user is able to send and receive money, pay bills, pay and receive transactions, and engage in other financial transactions, without having to retype his bank account information.

PhonePe acts as an intermediary between the user and his bank account. PhonePe uses UPI to provide consumers with access to a bank’s services through a mobile phone, without ever having to visit a bank or even use internet banking. One can transfer money from within the application with only the number of the receiver’s phone or VPA and no need to complete bank account information. In the case where both the receiver and the donor are users of UPI or PhonePe, the transfer happens in almost a split second. This is very effective and has led millions of individuals in India to move to cashless transactions without causing much disruption.

With the help of the UPI system through PhonePe, one can send money to relatives, friends, or anyone else in a matter of seconds. The money is credited directly from the sender’s bank account to the receiver’s account and debited immediately. This avoids the wastage of time in not writing checks, receiving cash, or wasting time in long bank queues. Moreover, the process is also extremely secure as there is no room for entering the wrong account number or sending money to the wrong recipient. With the requirement of a mobile number or UPI ID alone, the opportunities for errors are greatly minimized.

Apart from peer-to-peer, PhonePe employs UPI to enable users to make payments at stores, restaurants, and retail shops. Many merchants today display a QR code at their cash counters, which can be read by the customer through the PhonePe application. Upon scanning the QR code, the app directly reads the merchant’s UPI ID and completes the payment after the customer enters his UPI PIN. Once more, funds are transferred from the customer account to the merchant account instantly, hence making the transaction fast, smooth, and easy.

PhonePe combines the robustness of the UPI system with additional features like electricity, gas, water, broadband, and DTH recharge bill payments. Instead of visiting multiple websites or offices, simply open the PhonePe app, choose a biller, fill in the details, and make the payment instantly. This is made possible by linking UPI’s various service providers and billers to the user’s bank account through the app. Each transaction is confirmed with real-time notifications, and users can download payment receipts directly from the app.

Another important feature of UPI that PhonePe leverages is the ability to check bank balance directly from the app. Customers are able to view their current bank balance without the need to log into their bank’s mobile banking app or visit an ATM. It is protected by a UPI PIN and makes it easy to use by customers to monitor their money at any time. The bank balance is always displayed in real-time, so that users are constantly reminded of how much they have on hand before making a payment.

Security is the core of the UPI system and therefore a fundamental part of how PhonePe operates. Each transaction involves verification by the UPI PIN, which also adds an additional layer of security. If the phone is lost or stolen, the application is safe until the owner enters his or her security information. Secondly, the UPI system encrypts customer data and therefore unauthorized users will be pushed to access personal or banking information.

Basically, UPI is the technology on which online payments in India are based, and PhonePe is one of the pioneers who are using this technology to make banking accessible to all fingertips. UPI facilitated individuals in solving their day-to-day money issues through just a phone and an internet connection. UPI enabled PhonePe to let users transfer money instantly, pay bills, make payments, view accounts, and carry out other financial activities without any hassle. It has enabled individuals to make payments to their banks, introduced millions to the digital economy, and provided for a cashless way of life that is fast, efficient, and secure. With the potential of UPI, PhonePe continues to revolutionize how India pays.

Read Also:

- UPI Apps Server Down

- Important News- What Is UPI & Pull Transaction: Which Is Being Prepared To Be Closed, Will This Stop UPI Fraud, Know From The Expert

- UPI Will Not Work On Inactive Mobile Numbers From April 1: NPCI& Decision To Prevent Cyber Fraud, Pull Transaction Feature Will Also Be Closed‘

- Origin Of PhonePe

- Definition Of PhonePe

- Mobile Wireless Technologies Issues And Challenges

- Introduction To Smart Phones And Mobile Computing

- Health Risks Due To Mobile Phone Use

Recent Posts

Effects Of Environmental Pollution

To date, in most developing countries, less information is given about the effects of environmental…

Causes Of Environmental Pollution

1. urbanization and industrialization Since the era of industrial revolution, man has continued to put…

Major Types Of Pollution

1. Air Pollution Air pollution can be defined as the presence of chemical compounds in…

Environmental Pollution

Almost every human activity resulted in a decline or decline in the quality of the…

Oppo’s Budget Friendly 5G Smartphone A5 Pro Launches

Oppo budget 5G smartphone A5 Pro came: 50MP camera IP69 Water-proof phone launched at an…

How To Change Your NEET Exam Center In 2025

The National Eligibility cum Entrance Examination (NEET) is a medical entrance examination conducted for admission…