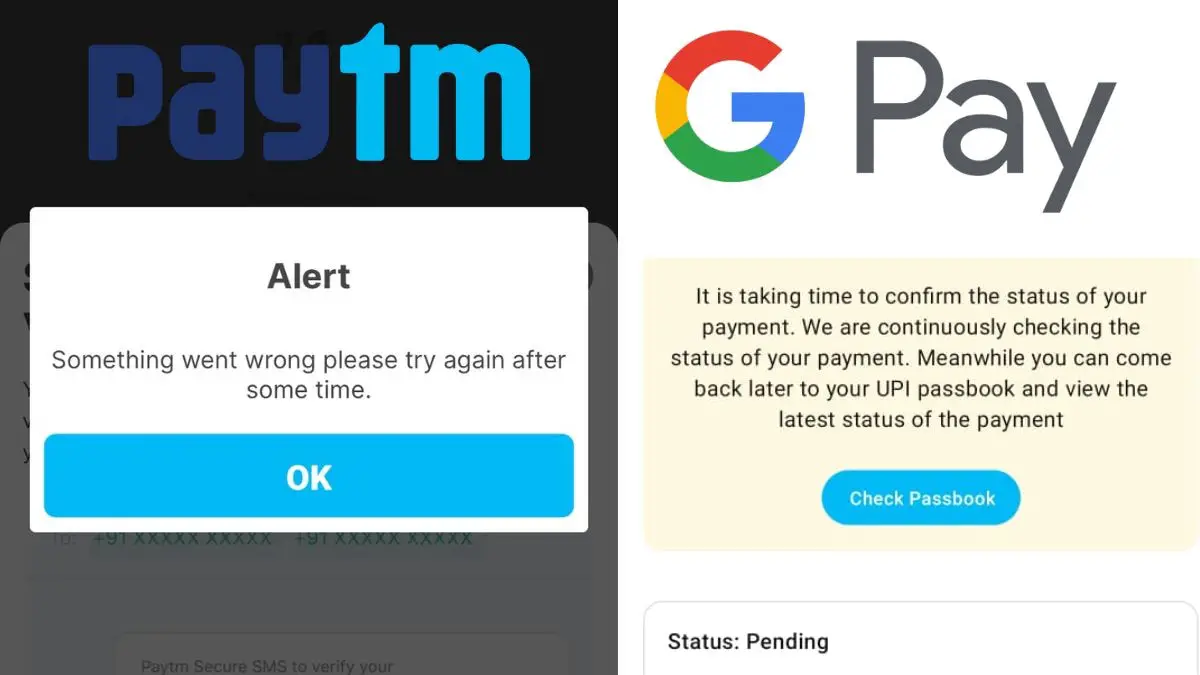

UPI Apps Server Down

Unified Payments Interface (UPI) revolutionized India digital payments space by enabling fund transfer directly from one account to another in real-time within seconds using mobile apps. This is applicable in apps like Google Pay, PhonePe, Paytm, Amazon Pay, BHIM, etc. As it becomes more popular, it also leads to an increase in the number of technical failures, especially server failures resulting in failed or timed-out transactions. These breakdowns not only cause huge inconvenience to customers but also make merchants deny transactions and lose confidence in online platforms.

This article discusses the critical points of time when UPI apps saw their servers go down, why they were brought down, the response from authorities and the public, and the guidelines provided to customers when this happens.

Key Examples of UPI Server Down

1. March 14, 2024 – Google Pay and PhonePe Down

There were thousands of users in India who were facing trouble with Google Pay and PhonePe on March 14, 2024. Payments were hanging on the “processing” page or not even working with error messages like “unable to reach bank server”. The complaints peaked at 10:30 am, and tweets were flooded with the likes of #googlePayNotworking and #Upidown, the docuseries said. The NPCI app later explained that the problem was caused by a backend update at one of the big banks that affected UPI connectivity for a few hours.

2. September 1, 2023 – BHIM app and some bank servers down

On this day, bank consumers of banks like PNB, SBI and Bank of Baroda and official app customers of BHIM UPI experienced failed transactions and app failure. The bug was up for over six hours and led to general inconvenience, especially for those transacting during the peak Ganesh Chaturthi shopping frenzy. NPCI acknowledged the glitch and said it was caused by load imbalance due to sudden traffic spikes. They recommended people to resume their transactions after some time or use some other UPI app on a temporary basis.

3. June 27, 2022 – PhonePe crashes during peak hours

On June 27, 2022, around 5 pm, PhonePe users reported errors such as “Transaction failed, please try again later.” The outage was particularly troubling as it coincided with month-end salary disbursements. Many merchants, especially food delivery partners and Kirana stores, were unable to receive payments. PhonePe released a public statement saying the issue was linked to NPCI’s UPI switch service which was temporarily inaccessible for some bank handles.

4. April 12, 2021 – cojoint outage of Paytm, Google Pay, and PhonePe

On that day, there was a blue-moon sensation when three of the most widely used UPI apps – Paytm, Google Pay, and PhonePe experienced a cojoint downtime. The downtime lasted for about 3 hours and was caused by an impromptu shutdown by the RBI at Yes Bank, affecting apps that heavily used Yes Bank’s payment gateway. NPCI later stepped in and resumed UPI transactions through other banks. This raised the issue of the importance of duplicate banking tie-ups for platforms like these.

5. August 15, 2020 – Independence Day glitch

There was a massive failure on Independence Day 2020 when UPI payments are heavily inundated due to online shopping discounts. Google Pay and BHIM apps were non-functional several times during 8 am to 3 pm. The reason for this was seen as infrastructure renovation in a couple of banks by NPCI. This was handled through collective efforts on the part of stakeholders.

Common Reasons for UPI Server Unavailability

UPI app server crashes can be caused by a variety of technical and administrative reasons:

- Bank server crashes: As UPI passes through each bank’s servers, whenever the servers of a bank crash, all UPI handles of the respective bank are affected.

- NPCI infrastructure crashes: Shared switches operated by NPCI can crash due to overloading or miss-routing.

- Software upgrades gone wrong: Ineffectively tested applications or backend patches can result in connectivity issues or server crashes.

- Cybersecurity vulnerabilities: Rarely, but conceivable, synchronized cyber-attacks or DDoS attacks can lead to brief outages.

- Overloaded surges: During festival days, sale days, or salary days, UPI payments go down and systems used extensively.

- RBI or GOVT action: Unexpected regulatory action, for example, freezing of banks or bank accounts, can upset all UPI apps connected with them.

Disruption of business and users

When UPI apps fail, the following are highly impacted

- Consumers: Consumers cannot accept payments at petrol pumps, restaurants or online portals in a timely manner.

- Merchants: Small shops and large chains that rely on UPI are seeing transactions coming to a standstill.

- Delivery agents: Most gig workers are completely dependent on UPI payments and receive delayed payments.

- Banks: They suffer from reputational damage and increased customer care calls.

Official and app responses

As soon as an outage occurs, NPCI and UPI apps usually respond via social media and official interfaces. However, users report that the message is not clear and comes too late.

Responses from stakeholders are usually:

- Push notifications: Apps inform customers about the issue that is currently being faced and advise them to try later.

- Social media posts: Twitter is usually the first place where apps post updates to users.

- Refund policies: Automatic reversal of failed transactions is usually processed within 2-3 hours.

What to do when UPI is down

Here are some practical tips for users when UPI servers are down:

- Try another UPI app: It may also be that just one app may be down; try switching.

- Use debit/credit cards: Hold the physical card as a fall back.

- Use wallet balance: If you have pre-loaded funds in a wallet like PayTM or Amazon Pay, use it.

- Have cash handy: Even in a digital payments era, cash remains the best bet in an outage.

- Check DocuSign or Twitter: Real-time reports inform you whether it is a local or systemic issue.

Conclusion

Although UPI has transformed payments in the digital space in India, server failures are a frequent occurrence. The increase in volumes – from tens of millions in 2017 to over 12 billion transactions a month by early 2025 – has put pressure on the infrastructure on the application and banking fronts. Better coordination between NPCI, banks and APP vendors will be essential to make things less frictionless. With the use of real-time data, open communication and leverage on technological upgrades, India can remain the world’s largest frictionless digital payments hub.

Read Also:

- Important News- What Is UPI Pull Transaction Which Is Being Prepared To Be Closed, Will This Stop UPI Fraud, Know From The Expert

- UPI Will Not Work On Inactive Mobile Numbers From April 1: NPCI Decision To Prevent Cyber Fraud, Pull Transaction Feature Will Also Be Closed

- Mobile Wireless Technologies Issues And Challenges

- Introduction To Smart Phones And Mobile Computing

- Health Risks Due To Mobile Phone Use

- Do Not Panic Due To Heavy Fluctuations In The Stock Market: Focus On Fundamentals Instead Of Hearsay, Adopt These 7 Most Effective Strategies

- Withdrawing Money From ATM Will Be Expensive From May 1: RBI Increased The Fee By ₹ 2, Now You Will Have To Pay ₹ 19 Charge For Withdrawing Cash After The Free Limit

- India Growth Will Help The Whole World: Bill Gates Said India Will Be A Developed Nation By 2047

- Study On Artificial Intelligence Applications Uses In Agriculture

- Artificial Intelligence (AI) In Agriculture: Current Status And Future Need

Recent Posts

Effects Of Environmental Pollution

To date, in most developing countries, less information is given about the effects of environmental…

Causes Of Environmental Pollution

1. urbanization and industrialization Since the era of industrial revolution, man has continued to put…

Major Types Of Pollution

1. Air Pollution Air pollution can be defined as the presence of chemical compounds in…

Environmental Pollution

Almost every human activity resulted in a decline or decline in the quality of the…

Oppo’s Budget Friendly 5G Smartphone A5 Pro Launches

Oppo budget 5G smartphone A5 Pro came: 50MP camera IP69 Water-proof phone launched at an…

How To Change Your NEET Exam Center In 2025

The National Eligibility cum Entrance Examination (NEET) is a medical entrance examination conducted for admission…