Different definitions of money have been given by different economists. F.A. Walker describes it in terms of functions. However, the followers of this view, G.D.H. Cole, J.M. Keynes, Seligman and D.H. Robertson, emphasize the ‘general acceptability’ aspect of money. For example, Professor Robertson says, “A thing which is widely accepted as a means of payment for goods or of discharging other types of business obligations is called money.” Seligman has pointed out that money is “a thing which has general acceptability.” Professor Ely says, “A thing which moves freely from hand to hand as a medium of exchange and is universally accepted at some time or other in the ultimate payment of debts is money.”

Prof. A. Walker has said, “Money is what money does.” But these definitions are defective because they do not give due emphasis to all the essential functions of money. Prof. According to Crowther, money is of high order because it accommodates all the essential functions of ‘anything that is generally acceptable as a means of exchange (i.e., as a means of determining credit) and, at the same time, serves as a measure and store of value.’ Moving on, however, money stands as the first commodity that led to the initiation of economic thought in man. “Still,” as one writer put it, “even at present there is virtually no unanimity as to the term used as money…In the business world people talk of money from many points of view; among economists there are probably as many different understandings of the term as there are different writers who use it.”

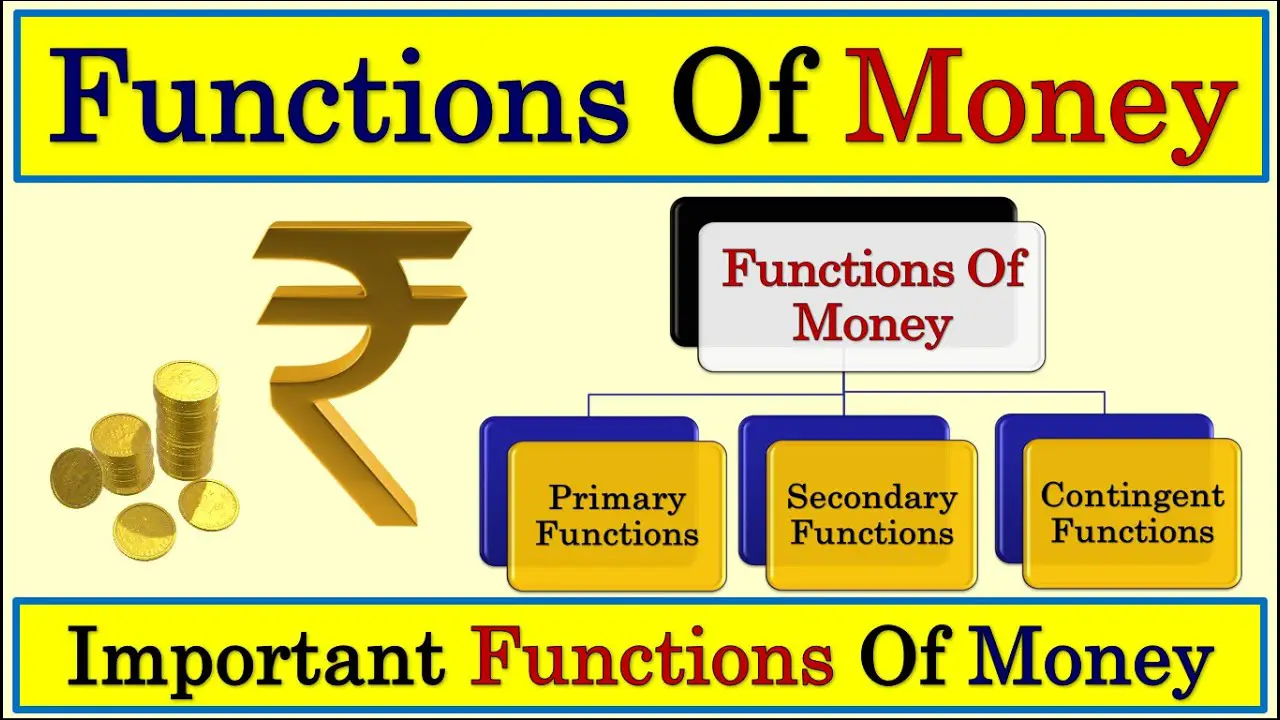

Functions Of Money

Among other things, money is a medium of exchange, a measure of value, a standard and a store of funds. That is, money performs functions in the modern economy which Kinley has grouped under the functions of money; these are:

(a) primary or cardinal functions, i.e., means for the most indispensable things, such as medium of exchange and measure of value; (b) other functions such as standard of deferred payment, storage of value and transfer of value; and (c) other functions such as distribution of income or maximising and measuring utility etc.

Medium of Exchange: Money is a medium of exchange because it permits the sale and purchase of goods and under barter a third thing is eliminated in the form of double coincidence of wants. It is easy to sell wheat for money and that money can be used to buy rice when a person has to exchange wheat for rice.

Measure of Value: Money has also helped in simplifying the barter system through the provision of common standards for measurement. The most important property of money is its measuring capacity in respect of various commodities. Money as a measure of value has made many transactions easy and simple. It may be understood that this function of money follows from the first basic function (medium of exchange). This is essentially because when money is used as a medium of exchange for commodities, each commodity acquires a value in terms of money (called price). As a result, money functions as a unit of account. In India, the unit of account is the rupee; in the United States, the dollar; in the USSR, the ruble and almost exclusively in Japan, the yen.

Store of value: Classical economists did not identify money as a store of value. Keynes stressed this concept. People accumulate money to deal with rainy days and unexpected contingencies. People also accumulate money to get increasing returns with changing rate of interest. Storage of money is done to maintain the value of money through time and space. Money as a store of value through time ensures the transfer of purchasing power from the present to the future and, therefore, acts as a vital link between the present and the future.

In this case money becomes an asset. Money is actually wealth or property because it provides claims. The most convenient way of making a claim is to put money on something that the person wants to buy, for example goods and services. This is why people prefer to keep their assets in the form of money rather than keeping it in the form of non-liquid such as a house or shares.

Therefore, of all assets, money is the most liquid, easily exchanged for goods and services without any difficulty, due to the fact that the price is stable in the sense of value at least in the short term. In fact, this is true for all assets like bonds, savings accounts, treasury bills, government securities, marketable securities, inventory and real estate which serve as stores of value but differ in the degree of liquidity, with money having the lowest liquidity in terms of value and the highest acceptability as a store of value preferred by people. However, the asset characteristics must be suppressed because the value of money does not always remain stable. Higher prices force people to get rid of money earning less value. In the modern economy money is never stored as money but is stored in interest-bearing securities.

Money is important only because value is exported through space; for example, an Indian, selling his business and property, settling in another country is an example of export of value through space. In ancient times gold and silver were used as currency and later currency notes replaced them. Today in advanced countries money is kept in bank deposits.

Standard Of Deferred Payment

Therefore, money is always kept as a deferred standard of payment. Where it gained better importance was in the field of credit as more trade progressed, making the function of money more necessary. Therefore, it became possible to talk about future payment in terms of money. A person who receives some amount of money from a lender today is obliged to repay it in future. Similarly, a person who has received goods on credit has to pay at a future date when he has liquidated the accounts payable and waited till it becomes due. Delayed payments are possible only because money serves as a perfect measure of future commitments and expectations.

Incidental Functions

Furthermore, the functions of money, namely primary and secondary functions of money, were emphasized by Professor Kinley on incidental money functions. It is facilitating the sharing of national income among various factors of production, whereby it amplifies the cooperative effort and contribution of land, labour, capital and organisation in one act of production, thereby creating a product which jointly belongs to all the factors. By using money for distribution of joint products among various factors this can be done easily and at the same time paves the way for economic progress. Moreover, utility is usually measured in terms of money; the utility of both consumers and factors of production is measured by consumers who are also producers through the money provided by money and strive for maximum possible satisfaction or returns. Undoubtedly, credit is the foundation of modern economic advancement. If stated in a nutshell, recourse would refer to the present reputation or trust of some kind or the other relating to past transactions.

According to credit theory the basis of credit is money. Credit is created by banks out of nothing else but money. Anyway, money gives liquidity to investments, because it is the fastest and easiest way to convert money into cash. Thus, it follows that money has various functions: money serves as a medium of exchange, it is a measure of value, it is a store of value, it serves as a standard of deferred payment, and finally, it is a basis for credit and distribution of national income. These functions of money are not equally important, and among them the most important function of money is that it serves as a medium of exchange, and, thus, at the same time, as a means of payment. As a generally accepted commodity, money immediately becomes both a unit of account and a measure of value in the process of exchange between commodities. From the above brief description, the table below shows the above functions of money.

Role Of Money

The use of money plays two roles in the determination of income and employment. On the one hand, it is the most conspicuous means through which income and employment are determined. It may also be regarded as a basic problem of macroeconomics, which involves issues relating to the long-term rate of growth of income in the determination of income, output, employment and the applications of the general price level. With regard to growth theory as available today, the demand for and supply of money has been virtually ignored; however, all except the simplest short-term income and price level determination models involve the money market.

Money has been allowed to act as a major economic force through which, under certain circumstances, economic activity may be stimulated or retarded in unexpected ways because money matters. This is the traditional economic discussion of money. Monetary theory, then, is the branch of economic science whose job it is to trace all the processes in which money in various forms is used to make possible the production, consumption or distribution of goods. They are in fact sustained by the fact that many other factors determine the level of production, consumption and distribution. It does not veil money as the means by which the exchange of goods would be facilitated. In his understanding, money has a much deeper and more central value in the context of all factors and economic activities in general.

For many monetary theorists, money not only has the special capacity to function as a medium of exchange, or as a store of value, as a measure of price or value for purchasing things in a certain amount and time; but more importantly, it comes with properties that can influence the behaviour of economic activities other than those taking place in a barter economy. On that latter note mention, Keynes claimed money as playing a role of its own. That is, it influences motives and decisions and in essence is one of the operational factors in the situation, so that without knowledge about the movement in the behaviour of money from the first situation to the final situation, the sequence of events is clearly undetermined in the long term or even in the short term. According to these views, money is not an isolated or neutral phenomenon because it was being governed by different principles than those having an influence on the process of production and exchange.

These are the two areas into which modern income and expenditure analysis falls – the real sector or the goods market which describes the forces of demand and supply to establish a balance of income and employment through the total product, as well as the other side, the monetary sector, covered by the forces of demand for money. In the modern perspective, the existence of a separate monetary sector of activity has been given meaning: events in the monetary sector can affect the level of both output and employment suddenly and with undue speed. To explain the money element, Keynes has incorporated it in the theory of interest, the dominance of the demand for money in the determination of the interest rate. Interest is the link between the real sector and the monetary sector and, in addition, plays an important role in the formulation of the theory of investment. Investment expenditure, one of the major determinants of income and employment, revolves around interest rates.

Read Also:

- 5 Functions Of Money

- Forms Of Money

- What Is Money

- Evolution Of Money

- Currency: What is it, How it works, and How it relates From money

Leave a Reply