Money and Currency

-

China Is Calling After Tariff Hike, Trade Deal Will Be Done In Three Weeks: Trump

Trade War • US President said – If there is no agreement, we have an option ready US President Donald Trump made a big claim that China has been contacting…

-

No Tax On UPI Transactions Above ₹2,000: Finance Ministry Calls GST Imposition Reports Fake; Incentive Scheme Extended Last Month

There will be no tax on UPI (Unified Payments Interface) transactions above Rs 2,000. The Finance Ministry on Friday called the imposition of GST (Goods and Services Tax) on transactions…

-

US Markets Drop 5% After Tariff Announcement: Market Cap Drops By Nearly $2 Trillion, Apple-Nike Shares Drop By 12%

Following the big news of the imposition of reciprocal tariffs announced by the President of the United States, it has been reported today that the US stock market index known…

-

US President’s Big Claim, India Agrees To Reduce Tariff: US Will Impose ‘Tit For Tat Tax’ From Tomorrow; China, Japan, South Korea United Against It

US President Donald Trump is going to impose tit for tat tax across the world from tomorrow i.e. April 2. Meanwhile, Trump claimed that India has decided to reduce tariffs…

-

America Will Impose ‘Tit For Tat Tariff’ From Today: Trump Will Announce It At The Make America Wealthy Again Event; Israel Removes Custom Duty On American Products

US President Donald Trump will announce the imposition of tit for tat tariff (reciprocal tariff) across the world on Wednesday. The White House said on Tuesday – Trump will give…

-

America Imposed 26% ‘Tit For Tat Tariff’ On India: Trump Said- Modi Is A Good Friend, But Is Not Behaving Properly; New Tariffs Will Be Implemented From April 9

US President Donald Trump on Thursday announced to impose 26% tit for tat tariff (reciprocal tariff) on India. Trump said- India is very strict. Modi is my good friend, but…

-

Decline In The Price Of Gold And Silver: Gold Fell By ₹ 119 To ₹ 90,996, Silver Is Being Sold At ₹ 99,536 Per Kg; See The Price Of Gold According To Carat

The price of gold and silver fell today i.e. on 2 April. According to the India Bullion and Jewelers Association (IBJA), the price of 10 grams of 24 carat gold…

-

Value Of 8 Of The Top 10 Companies Increased By ₹88 Thousand Crores: HDFC Bank Is The Top Gainer, Market Cap Increased By ₹44,934 Crores, Infosys’ Value Decreased By ₹9000

In terms of market valuation, the market value of 8 of the 10 largest companies of the country has increased by ₹88,086 crores in this week’s trading. During this period,…

-

Do Not Panic Due To Heavy Fluctuations In The Stock Market: Focus On Fundamentals Instead Of Hearsay, Adopt These 7 Most Effective Strategies

Due to the fall in the stock market for some time, the value of the portfolio of most retail investors has decreased. At such a time, it is not wise…

-

Withdrawing Money From ATM Will Be Expensive From May 1: RBI Increased The Fee By ₹ 2, Now You Will Have To Pay ₹ 19 Charge For Withdrawing Cash After The Free Limit

From May 1, you will now have to pay more charge for withdrawing money from ATM. Reserve Bank of India i.e. RBI has issued a notification announcing the increase in…

-

No Interest On Loans Up To ₹50,000: This Will Ease The Burden Of Small Loan Recipients; RBI’s New Guidelines Come Into Effect From April 1

The Reserve Bank of India (RBI) has said that banks, especially priority sector banks (PSLs), will not be able to charge any access fee for lending small loans. RBI says…

-

Important News- What Is UPI’s ‘Pull Transaction’: Which Is Being Prepared To Be Closed, Will This Stop UPI Fraud, Know From The Expert

The National Payments Corporation of India (NPCI) is constantly trying to stop payment fraud. For this, it is continuously strengthening the security features related to UPI (Unified Payments Interface). Now…

-

UPI Will Not Work On Inactive Mobile Numbers From April 1: NPCI’s Decision To Prevent Cyber Fraud, Pull Transaction Feature Will Also Be Closed

If you transact with Unified Payment Interface (UPI) and your mobile number linked to the bank is inactive for a long time, then activate it immediately. Otherwise, you may face…

-

Ready To Invest $2 billion In X: Sukesh In Letter To Elon Musk

Sukesh Chandrasekhar, a man who has spent time in prison for fraud charges among others, who has been in the headlines time and again with the letters he has written…

-

Similarities and Differences of Euro and Bitcoin Currencies

A payment role is the basis of every currency. Quite remarkably, both a traditional currency as well as a modern one resemble each other when it comes to the role…

-

The Role Of Money In The Financial System

It is one of the crucial parts of an economic system as it allows cash to circulate in the country’s economy. The system is formed by: • domestic and foreign…

-

Bitcoin Money

Bitcoin is the new internet money. It is decentralized because it has no central issuing institution, operates outside of banks, governments and institutions. The currency is limitless, accessible through internet…

-

Artificial Money And Its Lifecycle

If we want to understand the notion of artificial money, we must analyze what the contemporary world considers to be “natural money”. From a historical point of view, natural money…

-

Historical background Of Money

Money has undergone and is still undergoing an evolution. This evolution can point to certain “turning points” that can be considered “revolutionary” in the history of money. The first stages…

-

Introduction: The Nature Of Money

Money is a good, but if it is to function as a legal tender, all agents in the market must consent to use it as a vehicle of economic exchange.…

-

The History Of Money

Money is beautiful, money is interesting, money gives freedom – but like a spinning top, it must be kept in motion. Accumulate it and you become a slave… But where…

-

Demerits / Disadvantages Of Money

There is no doubt that properly managed money system has helped a lot in achieving high stable level of production, employment and real income. Money played an important role by…

-

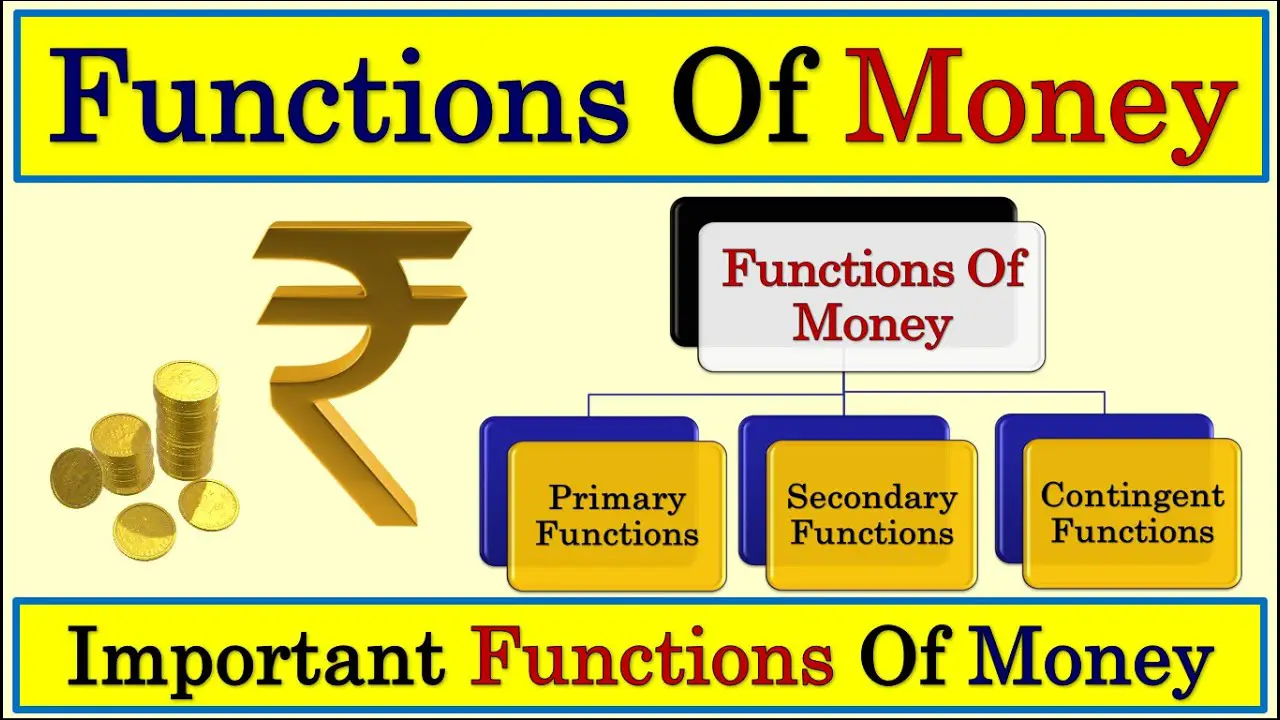

Money: Concept, Functions and Role

Different definitions of money have been given by different economists. F.A. Walker describes it in terms of functions. However, the followers of this view, G.D.H. Cole, J.M. Keynes, Seligman and…

-

5 Functions Of Money

The primary function of money in the economic framework is simply to facilitate the trade of commodities, which helps in carrying on trade without face-to-face interaction between traders. Money performs…

-

Forms Of Money

Money is a concept that we all understand but it is difficult to define it in precise terms. This is because it serves many functions and comes in many forms,…

-

What Is Money

Throughout history and around the world, money has taken diverse forms – from cowries, copper ingots, rum and gold coins in the past to coloured pieces of paper or polymers…

-

Evolution Of Money

Three basic needs are considered (food, clothing and shelter) These are some of the essential needs of a man (and woman too!). In the early ancient times, these needs were…

-

30 Facts About Loans

A loan is a money that one person, company or financial institution gives to another person with the agreement that over time, Will usually be paid back with interest. When…

-

1700 Plus Types of Loans

A loan is a loan borrowed from a lender, usually a bank, financial institution, or individual, with the agreement that it should, over time, Will usually be repaid with interest.…

-

300 Categories of Loans

A loan is an amount that a person borrows from a lender such as a bank over time, usually with an agreement to pay back with additional interest. Interest is the…

-

Evolution Of Loans

The growth of loans refers to the changes and developments in how borrowing and lending have progressed over time. Initially, loans were often informal agreements based on trust and personal relationships…

-

What is a Loan? Definition, History & Types

A loan is made when an individual, company or organization (known as a lender) funds, assets, to another person or group (known as a borrower), Or gives something valuable. The…

-

Evolution Of Indian Banking System

From the last two centuries in the Indian banking system has seen many types of development. In ancient time the Indian banking system was also being carried out by the…

-

9 Different Types of Loans

The proper meaning of loans are that a person borrow money to other person. Loan are also a type of financial tools that allowed customers , individual, organization , business…

-

11 Features and Characteristics of Banks

A bank is a type of financial institution that accepts money in the form of cash deposit from those peoples who have more amount of money. Banks also gives the…

-

Bank (Definition, Origin, Meaning, Types)

Banks are those types of financial institutions that provides various types of services to individuals, organizations, business and government. All total Banks in all over the world plays a important…